Client Center

What Can We Help You With Today?

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

This is a paragraph. Writing in paragraphs lets visitors find what they are looking for quickly and easily.

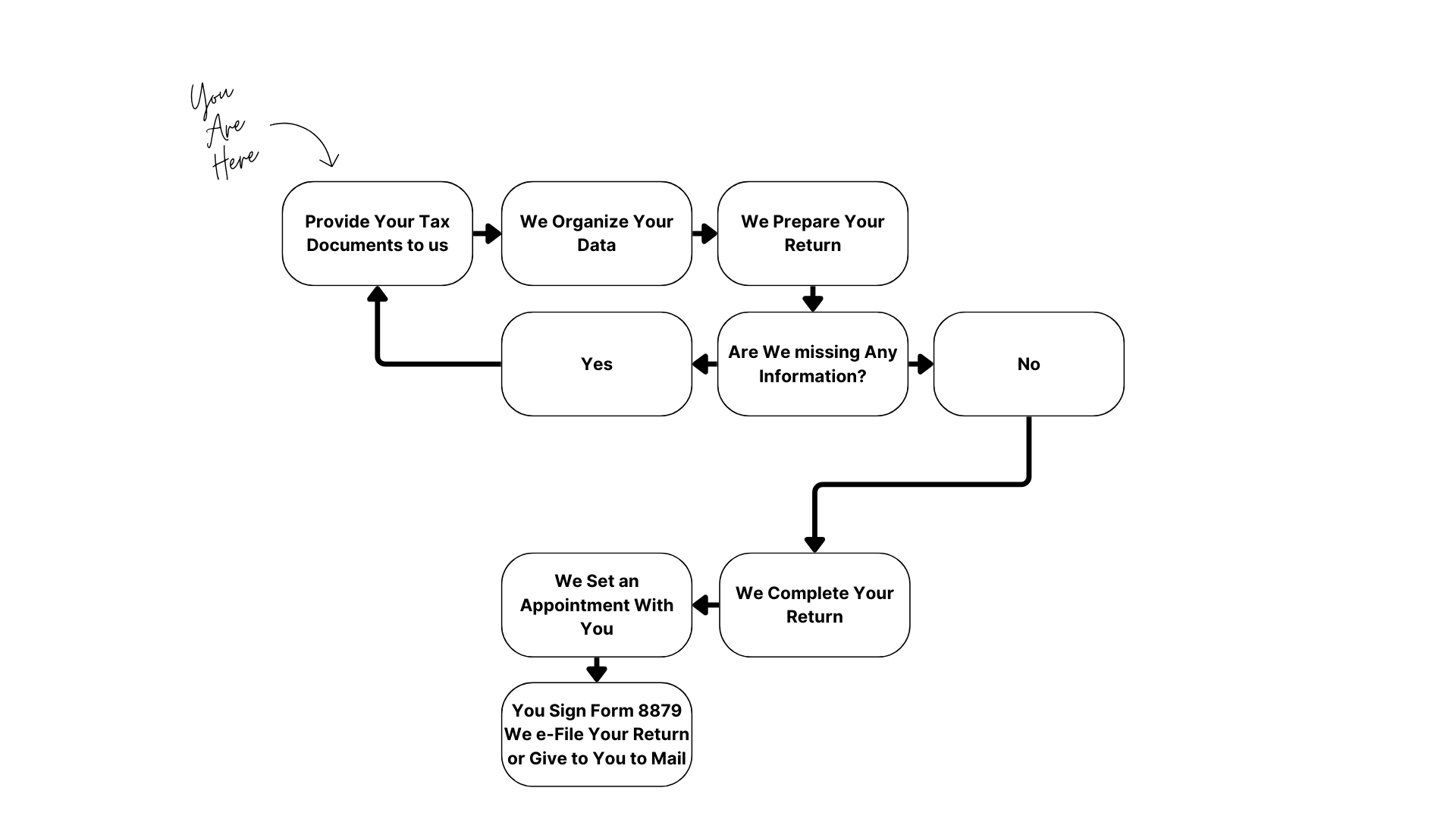

Our Tax Preparation Workflow

The Basic Steps of Tax Preparation

If you are a current client of Spitfire Accounting Group, or if you were a client of an accounting firm acquired by Spitfire Accounting Group in 2023, the following briefly outlines the process for having your taxes prepared and filed with us:

What Tax Documents do I need to Provide to Spitfire Accounting Group?

How Do I Provide the Tax Documents to Spitfire Accounting Group?

How Long Will it Take Until My Taxes Are Ready to File?

For Personal Taxes

For Business Taxes

You need to provide us with:

- Completed Personal Intake Form.

- Government Issued Photo ID (i.e. driver license, passport, etc.).

- Social Security Card.

- Copy of 2022 Tax Return (if you are a current client or a client that was part of an acquisition by our firm, we will have a copy of your return).

- Any IRS or State Notices or Letters.

- All Tax Documents

Filing Deadline for 2023 Personal Taxes is April 15, 2024

Deadline for Extension Filers is October 15, 2024

Beginning mid-February, all current clients of Spitfire Accounting Group, including all clients of firms acquired by Spitfire Accounting Group in 2023, you can provide your tax documents to us by either of the following methods:

- You can drop of all of the required forms to our office at 2877 Overland Ave, STE B, Billings, MT 59102 during normal business hours, which is 9AM-4PM Monday through Thursday or 9AM-2PM Friday.

- You can upload all of the required forms to our online Secure Client Portal. You will need to contact our office at (406) 281-8988 to set up unique log-in credentials for our secure portal.

If you are a current client of Spitfire Accounting Group, or you were a client of a firm that was acquired by Spitfire Accounting Group in 2023, then Spitfire Accounting Group will begin preparing your return when ALL of the required intake documents are received. The typical turn-around time for returns is approximately 10 days from the date that ALL required documents are received. The actual turn-around time will be determined by the length of time it takes to receive from you ALL required tax documents.

When your tax return is ready, Spitfire Accounting Group will reach out to you to schedule an appointment to come in and sign Form 8879 and file your return.

*If Spitfire Financial Group does not receive ALL required tax documents for your Business Return by February 28, 2023, an extension will be filed. The deadline for extension filers is September 15, 2024.

**If Spitfire Financial Group does not receive ALL required tax documents for your Personal Return by March 31, 2023, an extension will be filed. The deadline for extension Filers is October 15, 2024.

You need to provide us with:

- Completed Business Intake Form(s) (complete one form per business)

- Tax ID Registration Letter from the IRS

- Profit & Loss Statement.

- Balance Sheet.

- List of Assets/Equipment Purchased and Sold.

- Any Change of Ownership

Filing Deadline for 2023 Business Taxes is March 15, 2024

Deadline for Extension Filers is September 15, 2024